We have recently finished a project with an international insurer whose headquarters is in the Netherlands Randstad area. The experience was extremely satisfactory, mainly due to the interactions with the quant development group, which was very knowledgable and provided a pleasant working environment, and the topic under investigation, which was the construction of a system to compute economic capital requirements of the firm. Hence it is interesting to remind ourselves of some of the regulatory requirements behind the insurance business.

Generically, economic capital requirements are attached to the solvency word, which denotes the degree to which assets exceed liabilities. The difference (if positive) is also known as own funds. Such Solvency Capital Requirements (SCR in short) are dictated the European Insurance and Occupational Pensions Authority (EIOPA), which will be referred to as the regulator in the rest of this post. In mathematical terms, capital requirements are Values at Risk (VaR's), hence variances at given confidence levels.

One such regulatory requirement is known as the Standard Formula. As the name suggests, this is a standardised calculation that all the firms are asked to implement. However, it might not exactly reflect the risk profile of any specific entity and moreover, some risks might be relevant for some entities only, while completely irrelevant for others. Our main reference for this post will be the original EIOPA documentation which can be found here or here.

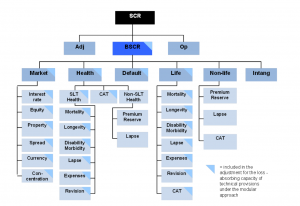

In the the Standard Formula calculations the various sources of risks are organised into a hierarchical structure (see picture). The root node represents the Basic Solvency Capital Requirement (BSCR) for the whole firm.

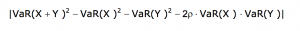

A capital requirement is calculated for each module in the risk hierarchy. All the capital requirements at each level are then aggregated into the parent level by using correlation matrices. The correlation parameters are chosen in such a way that the calculated SCR best approximates the 99.5% VaR over a one-year period of the aggregated capital requirement. In formulas, for two risk factors X and Y, the correlation parameter rho minimises the absolute difference:

Let's now look at each risk source in more details.

Market Risk

Generally speaking, market risk is related to the change of the values of assets and liabilities due to changes in market parameters (e.g. equities, interest rates, exchange rates, volatilities, etc.), which in turn affect the price of financial instruments.

Market risk contains the following sub-levels.

Interest Rate Risk. This captures risk in relation to all interest rate sensitive assets and liabilities. The upward and downward shocked term structures are derived by multiplying the current interest rate curve by an upward and downward stress factor. The stress is applied to the risk-free interest rates only (i.e. government bonds and LIBOR/swap rates). Principal Component Analysis (PCA) is then used to assess the stress factors.

Equity Risk. This captures risk related to all equity sensitive assets and liabilities. Equity are grouped into type 1 (less risky) and type 2 (more risky) and the economic capital calculation is either standard (mean reverting behaviour with symmetric adjustment mechanism) or duration based (lower stress is applied if the undertaking is exposed to a lower level of volatility of equities in the long-term compared to the short-term).

Currency Risk. Currency risk arises from changes in the level or volatility of currency exchange rates. Exposure to currency risk arises from various sources, including when the firm owns investment portfolios, as well as assets, liabilities and investments in related branches located in a different currency area.

Property Risk. Property risk arises when the firm owns real estate properties. The property shock is the immediate effect expected in the event of a fall in real estate benchmarks, where all direct and indirect exposures of the insurer to property prices are taken into account. The risk profile is the same for European properties as well as for properties located in third countries.

Spread Risk. The spread risk module is designed to reflect the change in the value of assets and liabilities caused by changes in the level or the volatility of credit spreads over the risk free term structure. It applies to bond and loans, structured credit products and credit derivatives. Capital requirements are computed for each of these classes and then added to derive the total SCR.

Concentration Risk. Concentration risk is restricted to the risk regarding the accumulation of exposure with the same counterparty. Typically an insures has many counterparties. For each counterparty the excess exposure is calculated and hence the corresponding capital requirement, which are then aggregated to get the total SCR.

Life

Generally speaking, this sector includes all life-related insurance contracts between the firm and private entities. A typical life-insurance portfolio is well described in terms of the following parameters:

- age

- gender

- smoker status

- socio-economic class

- level of life insurance cover

- type of insurance cover

- degree of underwriting applied at inception of the cover

- geographic location

This type of risk is typically associated with the uncertainty in the estimation of such life-related parameters. A good portfolio is one that is diversified with respect to all of them.

Life risk contains the following sub-levels.

Mortality Risk. The stress factor for mortality risk reflects the uncertainty in mortality parameters as a result of mis-estimation and/or changes in the level, trend and volatility of mortality rates and captures the risk that more policyholders than anticipated die during the policy term.

Longevity Risk. The stress factor for longevity risk is intended to reflect the uncertainty in mortality parameters as a result of mis-estimation and/or changes in the level, trend and volatility of mortality rates and captures the risk of policyholders living longer than anticipated.

Disability-Morbidity Risk. The stress factors for disability-morbidity risk reflects the risk that more policyholders than anticipated become disabled or sick during the policy term (inception risk), and that disabled people recover less than expected (recovery risk).

Expense Risk. Expense risk arises from the variation in the expenses incurred in servicing insurance or reinsurance contracts. It is likely to be applicable for all insurance obligations. Such costs include: staff costs, cost of commissions to sales intermediaries, cost of IT infrastructure, cost of land and buildings occupied.

Revision Risk. Revision risk is intended to capture the risk of adverse variation of an annuity's amount, as a result of an unanticipated revision of the claim process.

Lapse Risk. The lapse risk captures the adverse change in the value of insurance liabilities, resulting from changes in the level or volatility of the rates of policy lapses, terminations, renewals, and surrenders. The capital requirement for lapse risk is the maximum of the capital requirement in one of the following scenarios: a permanent increase of lapse rates, a permanent decrease of lapse rates, and the mass lapse event.

Catastrophe Risk. The life catastrophe risk stems from extreme death events that are not sufficiently captured by the mortality risk. Life catastrophe risks are one-time shocks from the extreme, adverse tail of the probability distribution that are not adequately represented by extrapolation from more common events and for which it is usually difficult to specify a loss value, and thus an amount of capital to hold.

Non Life

Generally speaking, this sector includes all non-life-related insurance contracts between the firm and private entities.

Non Life risk contains the following sub-levels.

Premium and Reserve Risk. The non-life premium and reserve risk takes into account losses that occur at a regular frequency. Premium risk relates to future claims arising during and after the period for the solvency assessment. The risk is that the expenses plus the volume of losses for these claims are higher than the premiums received. Reserve risk stems from two sources: on the one hand, the absolute level of the claims provisions could be mis-estimated; on the other hand, the actual claims will fluctuate around their statistical mean value because of the stochastic nature of future claims payouts.

Lapse Risk. A lapse is the cessation of a privilege, right or policy due to time or inaction, so a lapse of a privilege due to inaction occurs when the party that is to receive the benefit does not fulfil the conditions or requirements set forth by a contract or agreement (source: Investopedia). For non-life lapse risk, it is assumed that either relevant option exercise rates are not used in the calculation of technical provisions for non-life obligations or, if they are used, changes of the relevant option exercise rates would not have a material impact on their value.

Catastrophe Risk. This accounts for the possibility that a catastrophic event could happen, resulting in big losses. The non-life catastrophe risk includes three separate and independent sub-types of risk that cover catastrophe risk related to natural perils, man-made events and other catastrophe events.

Health

Generally speaking, this sector includes all health-related insurance contracts between the firm and private entities.

The health risk is split into 3 sub-levels, according to the technical basis of the health insurance obligations:

- Health (re)insurance obligations pursued on similar to life techniques (SLT Health)

- Health (re)insurance obligations pursued on similar to non-life techniques (Non-SLT Health)

- Health (re)insurance obligations exposed to catastrophe risk (Health CAT)

SLT Health. The underlying assumptions for the SLT Health underwriting risk module are assumed to be similar of in some cases the same as for the Life risk.

Non-SLT Health. All underlying assumptions for the Non-Life risk (except catastrophe) are assumed to be valid also for the Non-SLT Health risk.

Health CAT. The health catastrophe risk is based on standardised scenarios as a method for the estimation of the catastrophe risk charge to apply across all countries for medical expense plus accident and sickness products.

Operational Risk

Operational risk derives from inadequate or failed internal processes, personnel or systems, or from external events, unless the firm is well diversified and managed. The overall assumption is that a standardised level of risk management is present. The operational risk module is based on a linear formula, and is therefore not risk sensitive.

Counterparty Default Risk

The counterparty default risk is designed to reflect the change in the value of assets and liabilities caused by unexpected default or deterioration in the credit standing of independent counterparties and debtors. Exposures are classified in type 1 and type 2. The capital requirements for the two types are computed in terms of loss given default (LGD) and recovery rate (RR) and then aggregated with a given correlation.