During our Testing & Finance 2012 talk we demonstrated how the concepts used by HROs can be used to manage the operational risks faced by modern financial institutions.

At financial institutions, the Chief Risk Officer’s primary concern is detecting and preventing catastrophes before they occur, i.e. managing risk. While financial risks are important, operational risks are becoming more so. Controlling these risks requires a new attitude to making changes, testing, releasing software and developing the right team.

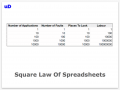

Most operation departments capture complicated processed and computations in spreadsheets. Some automation can be achieved with macro scripts, but in general the level of automation is low. Once the logic has been captured in spreadsheets, lower skilled colleagues are put in charge of the day to day operations. Although cost effective, removing the more skilled employee will make it harder to detect errors and cope with increasing risk. The alternative is to model financial organizations on High Reliability Organizations (HROs).

Within this framework, we talked about how Agile methodologies, and specifically Agile testing methodologies, can be used by placing them in a framework more attuned to a CRO’s needs. This process is SAS70 compliant by nature due to its strict accountability.

(Click any slide to start presentation mode)